This post was originally published on this site.

I never take the flood of forecasts that investment banks and brokers produce at the start of the year very seriously, but this isn’t because the analysts who produce them are fools. Most people who work in these jobs are smart and knowledgeable. Yet the tendency of the investment industry to reward moderate bullishness at all times means that very few can put out a genuinely unconstrained view.

There are not many analysts who have the freedom to write that they think investors should have zero exposure to the US, as Jeremy Grantham argues. Right or wrong, it is clearly a strong opinion, while simply saying that investors should be “market weight” in US equities does not offer much to chew over.

Sign up to Money Morning

Don’t miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don’t miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

AI spending is forecast to rise in 2026 – should investors keep backing it?

Spending on AI will keep rising, but the prospects for a technological revolution are so great that the bigger risk is not being invested. (It’s notable that fund managers seem to be rather more worried about whether there is an AI bubble than brokers are.) Stocks will go up, although there is much less optimism than last year about whether America will outperform the rest of the world after it fell behind in 2025. No region seems to stand out as a consensus pick, although there is quite a bit of interest in Japan. Interest rates will fall, especially in the US, which will be good for bond markets. However, nobody is getting especially excited about traditional credit (eg, corporate bonds) – not because they are forecasting disaster, but because valuations are fairly steep: there’s not much extra yield to pick up from riskier bonds compared to safer ones. Conversely, enthusiasm about private credit (eg, loans made directly by investors to companies) still seems high, despite a couple of high-profile defaults in the past year. Oil will remain under pressure. Gold will keep going up. Industrial metals such as copper and aluminium could do well due to tight supply and rising demand from AI infrastructure.

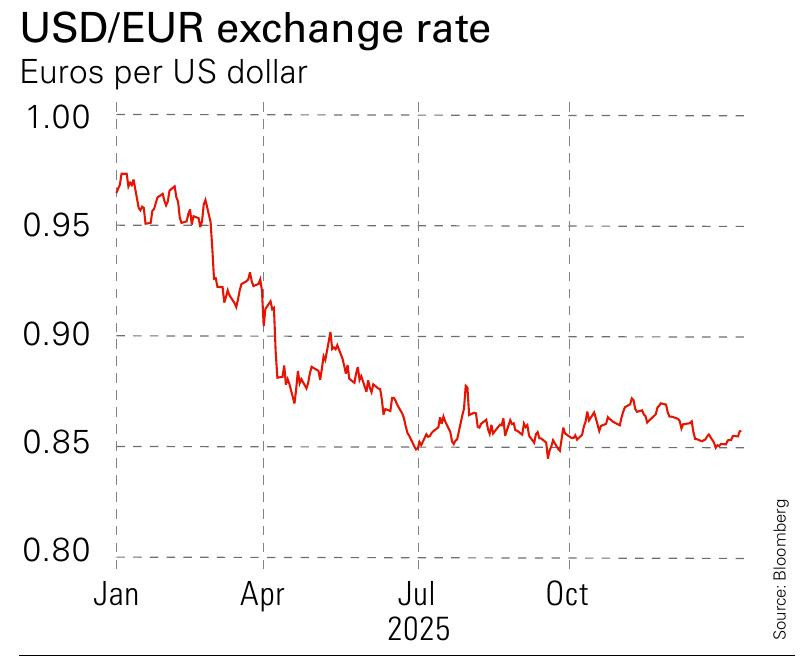

The biggest shift compared with last year seems to lie in the currency markets. Back then, the consensus was that the dollar would keep getting stronger as a result of foreign capital flowing into US markets and Donald Trump’s policies being helpful for the US trade deficit. In the end, the dollar weakened against most major currencies in the first half of the year before stabilising.

This year, most forecasters expect a weaker dollar, on the basis that interest rates will fall faster in the US than elsewhere. The other reason to expect this largely goes unsaid: the tail risks created by the Trump administration’s increasingly unpredictable policies are changing how investors feel about the US and making them – at the margin – more inclined to look for opportunities elsewhere. Based on the events of this week, we should expect that to continue.

(Image credit: Bloomberg)

This article was first published in MoneyWeek’s magazine. Enjoy exclusive early access to news, opinion and analysis from our team of financial experts with a MoneyWeek subscription.

Explore More

![[Aggregator] Downloaded image for imported item #507321](https://www.sme-insights.co.uk/wp-content/uploads/2026/01/rpCMuramficeEJ8FAyWDGN-1280-80-1068x761.jpg)