This post was originally published on this site.

From customer experience to collaboration, security to content management, Zoho leads the way in AI for business.

Recently the company discussed closing another AI gap, this time in finance.

“Many people don’t take full advantage of our customization capabilities, even with very good low code, no code features,” says Prashant Ganti, Head of Finance Platform, Zoho.

AI makes these customizations easier than ever before.

Where You Need AI in Finance

AI customization in the Zoho Finance and Operations Platform runs the gamut from invoice creation to reconciliation and anomaly detection.

An important caveat must be considered here. AI in the Zoho ecosystem does not appear as one big all-encompassing feature.

Instead, think of it as peppered throughout Zoho’s many financial tools giving assistance where and when it is needed.

“It shows up in small but several meaningful ways that finance teams already work.” Ganti says.

Zoho’s AI provides the heavy lifting in a number of areas where traditionally finance teams put in considerable manual effort.

It offers levels of automation, customization and financial and operational oversight hitherto requiring considerable extra input from your team.

And suppose, as is the case with many small businesses, you are that team!

Take Back a Little of Your Time

Imagine you run a commercial cleaning business in Saginaw, Michigan.

Your roles include managing around 10 employees plus marketing to grow your business, inventorying cleaning supplies, and handling client communication.

But wait! What about handling your business’s finances?

This covers everything from billing your clients on time to managing your expenses to seeing your employees get paid.

That probably means spending some extra time in the evening with your bookkeeping software. But somehow you need to get to your daughter’s dance recital.

And first you need to do some grocery shopping and get an early dinner ready so everyone in your family can get there on time.

Bet you wish there was a way to reclaim some of those hours!

Learn Important Insights

Of course, saving time isn’t the only benefit of using AI features in small businesses. You also get the opportunity to see your business in new ways.

Imagine the challenges of a private nursing service in Vancouver, British Columbia.

With about 20 employees servicing home and other clients, you would find your days filled with scheduling, compliance with local regulations, client intake and managing equipment.

But valuable insights could be drawn from your financial records if only you had a team to suss them out.

For example, projected increase in demand for services might let you know it’s time to hire another employee.

But knowing ahead of time gives you flexibility instead of needing to quickly fill a position when the need arises.

Smart home integration represents a growing trend in home healthcare. This service allows continuous real-time monitoring of home bound patients.

You may have started such a service but spotting a growing demand lets you know it’s time to invest in more remote patient monitoring equipment.

These include things like wearable sensors, smart thermometers and other connected devices.

In both cases above, AI features in the Zoho Finance and Operations Platform can eliminate friction and help you move faster.

However, small businesses may use these features in a variety of ways, depending on need.

Have a Chat with Zia

But even with all this power under the hood, how do small businesses find the time to use AI customization to their advantage?

Fortunately, it all starts by having a little conversation with Zia.

Zia happens to be Zoho’s signature AI assistant. As the company states on their website, Zia runs behind the scenes but also responds directly to queries and prompts.

According to Ganti, uncovering the incredible values of Zoho’s AI enhancements in finance doesn’t involve hunting though more than 12 different Zoho financial products.

“You can just ask what you need or act directly without navigating a lot of screens,” he explains.

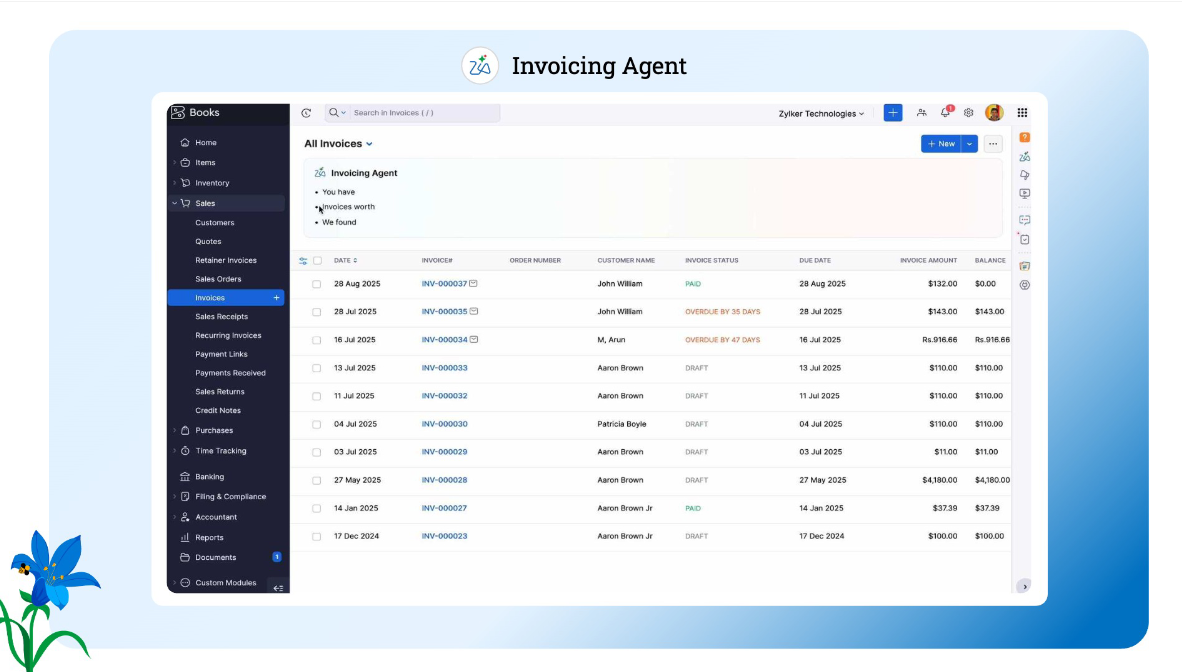

In a few clicks, he shows how prompting Zia can put the information you need instantly at your finger tips.

“Here’s creating an invoice, pulling customers who brought a product, sending a payment reminder, checking for outstanding invoices, all from a single interface,” Ganti says.

Get Help Creating an Invoice

Say you’re a web developer in Dhaka, Bangladesh, or a content creator in Walla Walla, Washington.

Both these small businesses share a common need. And it makes no difference they happen to be located on opposite sides of the planet.

Both want to get paid once they’re delivered on a big project for a client.

But both also share a common problem.

Akash works alone in rented space at an incubator located in a Dhaka suburb. Melissa works in a converted office above her parents’ garage in the U.S. Pacific Northwest.

Neither of these hypothetical business owners have a billing department – or any backoffice for that matter.

So sending out invoices means half an hour or longer in a graphic program or their bookkeeping software – neither one’s long suit.

Contrast this with using Zia’s invoicing agent. The benefit in Zoho’s use of AI remains the fact that these features will do as much or as little as you need.

“Zia can help you create an invoice, but it doesn’t need to take over. It assists,” explains Ganti.

So, for example, your invoicing agent populates fields for customer, location, invoice number, date, and order number.

It marks the invoice as “accounts receivables”. All of this information can be quickly pulled from existing data – especially in the case of recurring invoices.

Finally, it can provide a description for your customer of what services the invoice covers.

Of course, Zia needn’t do all that without your input.

“At any point in time the user can step in to change details, validate numbers, adjust logic,” says Ganti. “We believe that balance is very, very critical in finance.”

A few minutes later you have a professional looking and itemized bill on its way to a client.

Harnessing the Power of Zoho Apps

In the above example, Zia draws primarily from Zoho Invoice. The popular free Zoho app provides a boatload of features.

Zoho invoice allows small business owners to streamline invoicing and collecting payments from clients.

With Zoho Invoice you can:

- Make professional looking documents for your clients.

- Check for any necessary tax compliance issues.

- Send invoices to clients in more than 15 languages.

- Allow for a variety of payment options.

- Turn your approved project estimates into invoices.

- Track hours on projects and bill automatically for time worked.

- Create transparent access allowing clients to add payment info and star ratings.

And AI makes this whole process even simpler. But Zia can draw from even broader sources across Zoho’s finance ecosystem.

Just watch!

Giving You A Snapshot

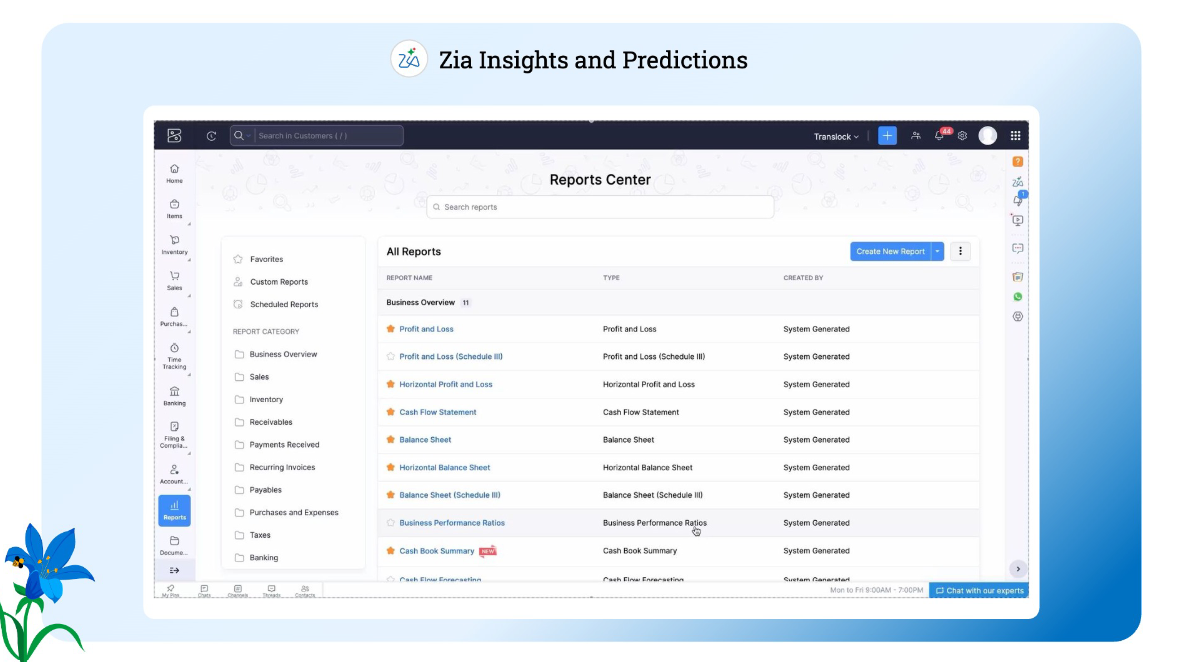

Zia also offers help creating reports. Overviews on profit and loss, cash flow and liabilities and equity can be created with simple prompts.

These reports assist business owners in seeing what is happening inside their company from a variety of different perspectives.

For example, it offers a snapshot of where your business is now. But perhaps more importantly, it presents insights and predictions about where things are headed.

In the example of the independent nursing service, you see where these kinds of predictions can allow you to exploit unrealized opportunities.

But such predictions also allow a business owner to avoid dangerous pitfalls in their businesses as well.

How Insights and Predictions Work for You

Imagine you operate a general construction contractor in Topeka, Kansas specializing in custom built homes.

At first glance, business seems good. But after seeing some alarming costs coming in from subcontractors you decide to do a deeper dive.

After using Zia to create a customized profit and loss projection over the next five years, you get a nasty surprise.

Though profits are indeed increasing, you realize increases in the costs of subcontracting services like electrical, plumbing, carpentry and masonry will soon overtake them.

What’s worse, costs of materials including wood, steel, copper, aluminum and concrete also continue to rise.

Though the report may prove upsetting, it also serves as a wakeup call. The projections have given you time to react.

Over the next few months, you focus on seeking cheaper sources for materials and making changes in your building process to save costs.

You also need to negotiate with subcontractors to reduce costs or find replacements. And, of course, you need to adjust your builder’s fee and increase the number of projects in your pipeline.

This represents considerable effort, but would have been impossible without AI insights from Zia.

Pulling Things All Together

Reports like these become possible only because Zoho’s AI features allow you to pull together data from across its finance ecosystem.

Materials like invoices, related sales orders, estimates, customer details, and much more can be assembled into reports that reveal a variety of insights, Ganti explains.

Hunting for these insights amongst all the data you and your team have compiled over months and perhaps years would be daunting.

“There is a lot of resistance and people may not actually get the information they want,” Ganti explains.

But a few prompts to Zoho’s AI may turn all that around. Suddenly, you possess actionable data.

“Here, you tell the system what you want and it’s able to build that report for you,” Ganti adds.

These reports forecast changes or trends based on historical patterns.

In short, they give you and your team a kind of crystal ball to see into the future of your business and prepare for it. And that beats playing catch up any day.

Using Anomaly Detection

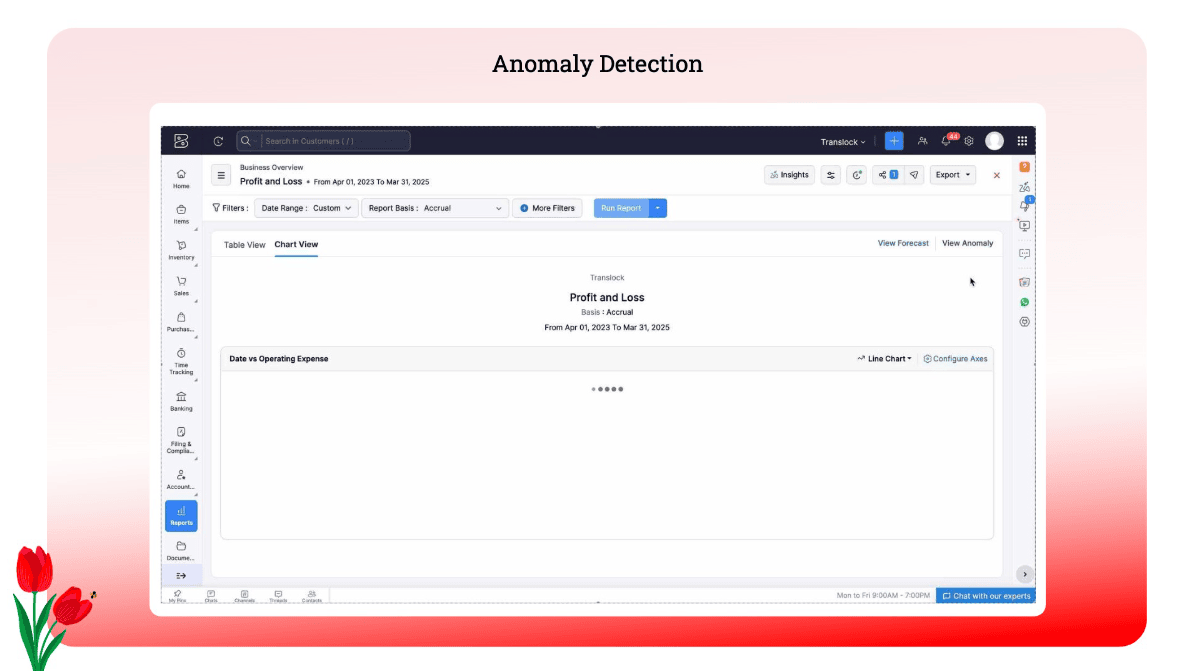

Zoho’s AI integration offers yet another way to analyze finances in your small business for a very different threat.

Zoho’s anomaly detection draws together data to show things like spiking expenses or falling revenue before a quarterly review might detect them.

“This again is very important, helping users to spot things that don’t look right, catching issues earlier,” Ganti explains.

However, in this case, changes happen not gradually over time with implications in the future. They happen more suddenly.

And such changes may indicate problems that need a quicker response.

Playing Detective with AI in Zoho Finance and Operations Platform

So, how might this all play out in a small business setting?

Let’s have a closer look.

Imagine an education company in Minneapolis, Minnesota selling online courses for download.

A few reports compiled by the financial officer show some alarming anomalies.

Though downloads of courses remain steady, one report shows an unexpected decline in revenue over the last few weeks.

Meanwhile another report shows an alarming sudden uptick in expenses despite no significant change in operations.

A bit of digging reveals an increase in chargebacks by customers disputing payments after downloading courses.

At the same time the company’s content marketing agency increased billings for additional projects that were never approved.

Our hypothetical education company disputes the chargebacks all occurring through the same payment portal and flags this vendor as higher risk in the future.

They also dismiss their content marketing agency after a compromise cannot be reached on the billing dispute.

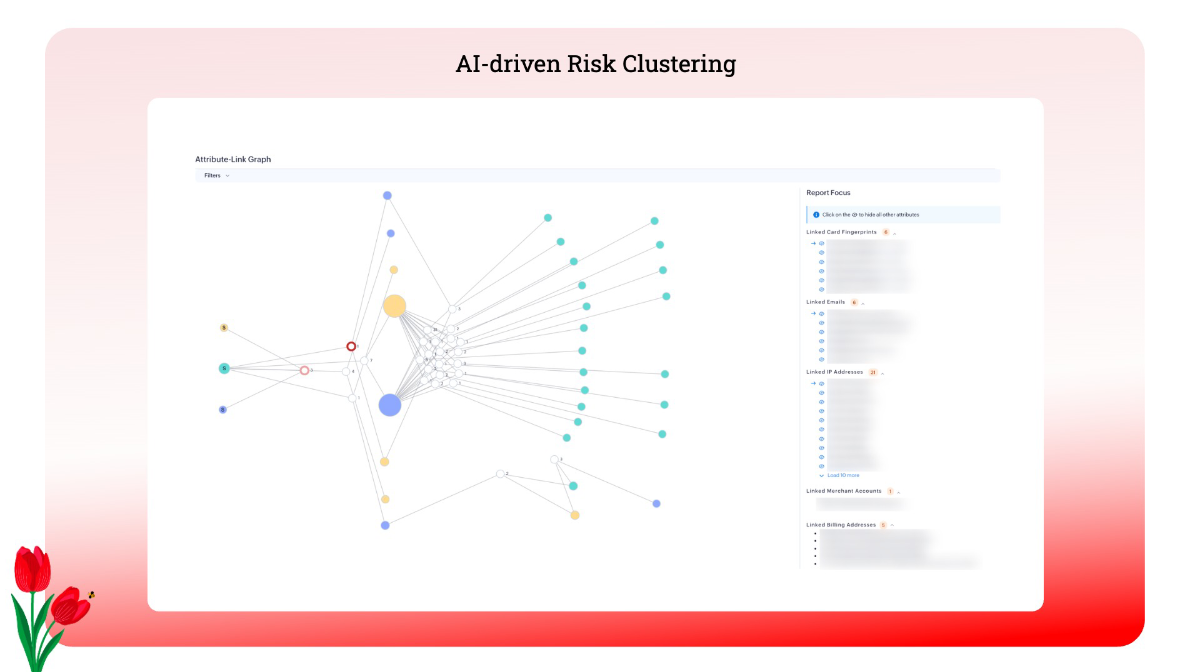

Zoho Payments Uses AI to Flag Risks Already

One additional point needs to be made with regards to AI used to flag fraud.

As part of its Zoho Payments platform, Zoho already uses AI behind the scenes to separate vendors using its payment gateway into risk categories.

Zoho’s AI works to identify suspicious payment modifications, assign risk scores and block suspicious transactions.

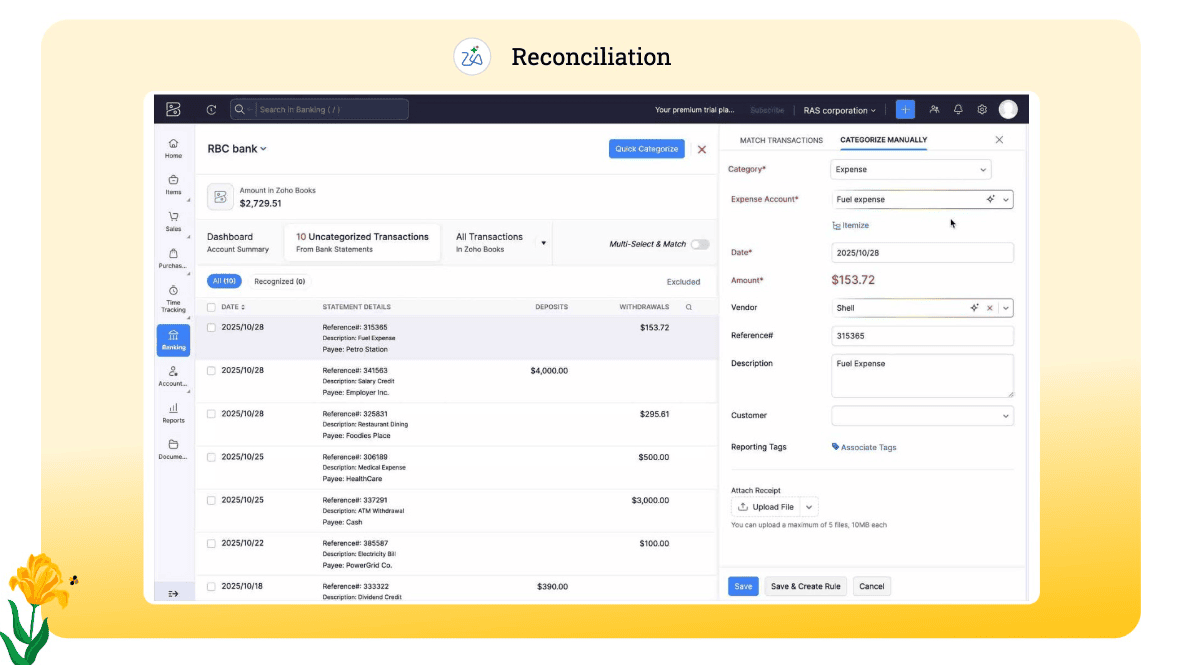

Streamlining Reconciliation Leaves More Time for the Big Stuff

Finally, reconciling bank statements, accounts receivable, accounts payable and expenses represent a time intensive activity.

This happens to be true whether it is performed by your team – or by you depending on the size of your business.

Wouldn’t it help to automate this process with a system that learns, reconciles and even categorizes repeating incoming payments, expenses and all the rest?

“So most finance professionals don’t want to spend time on reconciliation first thing on a Monday morning,” Ganti explains.

Now they don’t need to and can get on to more important tasks to help you grow your business.

Final Thoughts

From invoice creation to insights and predictions, anomaly detection to reconciliation, Zoho Finance uses AI to streamline operations and increase knowledge.

When you know more about the financial health of your business, you can respond proactively to problems where they exist.

For more on how the Zoho Finance and Operations Platform and its AI updates can help your small business thrive, contact the Zoho sales team today.

![[Aggregator] Downloaded image for imported item #530226](https://www.sme-insights.co.uk/wp-content/uploads/2026/01/Zoho-Finance-December-Review-v2-1068x596.png)