This post was originally published on this site.

Cryptocurrency does not feature in our strategic portfolio, partly because we are not yet converts to the idea of crypto as a fundamental asset. There’s an obvious appeal to the idea of a currency that lies outside government control. Yet the two biggest cryptocurrencies – bitcoin and ether – have significant disadvantages for transactions compared with existing payment networks. The need for a stable store of value is obvious given the growing long-term risks of currencies being debased. Yet gold still seems a superior choice in almost all ways. All this makes it difficult to decide whether cryptocurrency is truly a revolution that will find more and more mainstream applications, or the ultimate expression of our bubble-prone era.

Still, we certainly cannot not dismiss the way that bitcoin has soared over the past decade. Yes, much of this took place against a backdrop of ultra-low interest rates, which created many bubbles. More recently, the pro-crypto stance of the Trump administration gave it a further boost for equally speculative reasons. To the extent that US government has a coherent policy, it is to encourage stablecoins – digital currencies backed by assets such as government bonds – in an attempt to entrench the dominance of the dollar and provide a steady source of demand for the vast amount of US Treasuries it is issuing. (This is very different to supporting bitcoin and ether.)

That said, if cryptocurrency is purely a bubble, it is a resilient one – bitcoin has rebounded from multiple huge sell-offs. The more that happens and the longer bitcoin and ether stick around, the more chance they find broader mainstream use. The adoption of new standards is often down to building faith in them, which comes from seeing them tested to see if they break.

Sign up to Money Morning

Don’t miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don’t miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Cryptocurrency ETFs are now available to UK investors

A secondary reason we haven’t used cryptocurrency is that, until late last year, private investors in the UK could not invest in regulated crypto exchange-traded products. This was always a bizarre decision, since it pushed investors towards unregulated exchanges with much less protection. Thankfully, the regulator belatedly saw sense, and we can now access products such as CoinShares Physical Bitcoin (LSE: BITP) and WisdomTree Physical Bitcoin (LSE: WXBT).

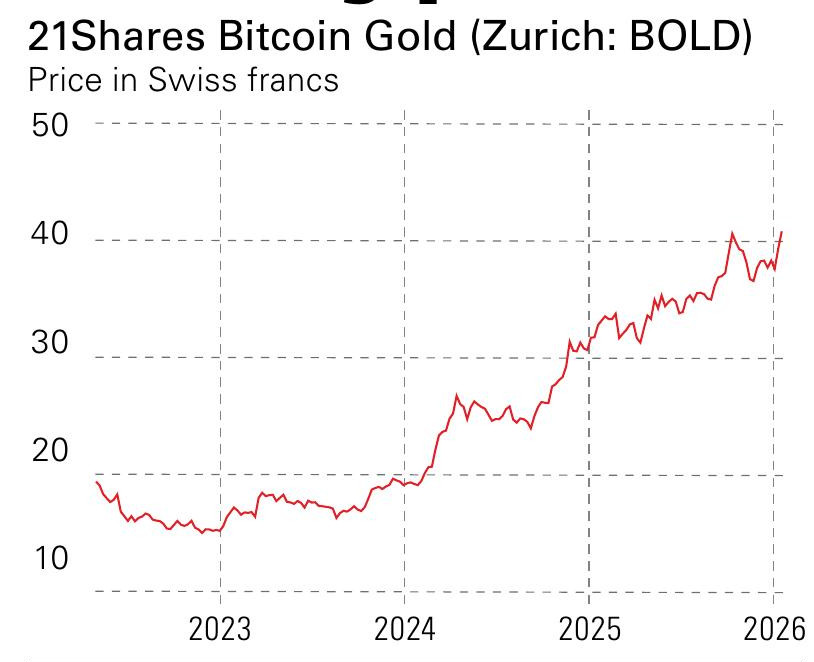

That’s why last week I was at the London listing of the latest crypto-linked product: 21Shares Bitcoin Gold (LSE: BOLD), created by MoneyWeek contributor Charlie Morris. BOLD is an interesting idea: it holds a mix of gold and bitcoin in proportion to their past volatility, rebalancing monthly. The principle is that bitcoin and gold have low correlation (bitcoin does well in risk-on conditions, gold does well in risk-off conditions) and hence can complement each other. BOLD has been listed on Switzerland since April 2022 and over that time has returned 108% with much less volatility than bitcoin (go to bold.report for more details).

(Image credit: Future)

I’m not proposing BOLD for our portfolio yet, but this is the kind of basis on which we might use cryptocurrency – not as a firm view on how it will be adopted, but rather the properties it shows when trading. Crypto-curious investors may want to take a closer look at how it performs.

This article was first published in MoneyWeek’s magazine. Enjoy exclusive early access to news, opinion and analysis from our team of financial experts with a MoneyWeek subscription.

![[Aggregator] Downloaded image for imported item #653799](https://www.sme-insights.co.uk/wp-content/uploads/2026/01/uLcBcqjfnVtTzL84roumTV-1280-80-1068x601.jpg)